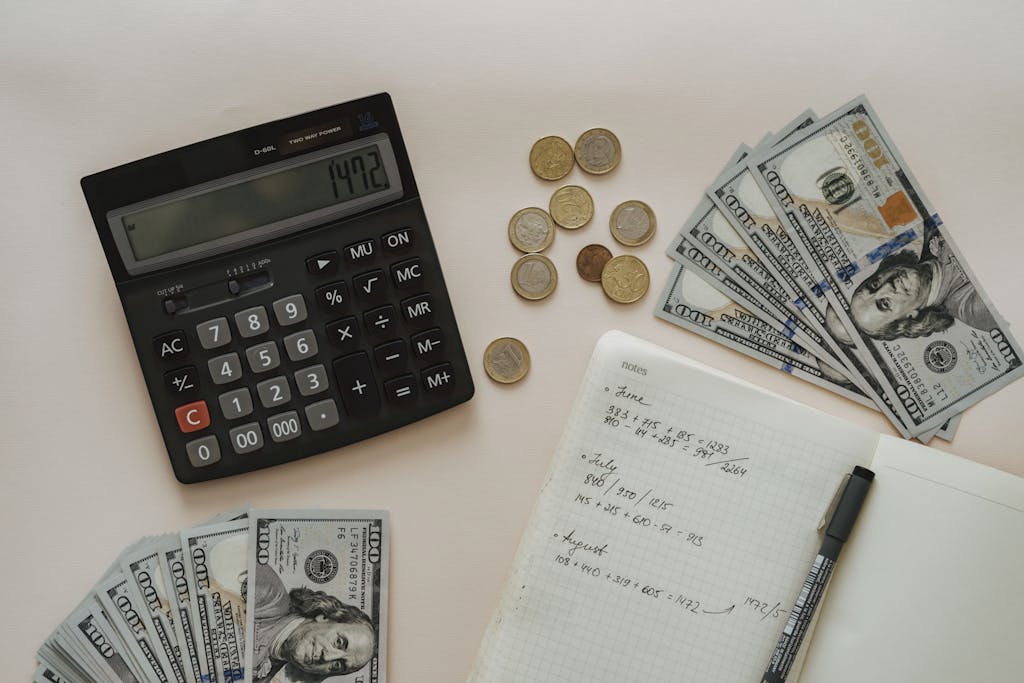

5 Ways to Save Money According to the Bible

The Bible often discusses the concept of financial stewardship. But what exactly does it mean to be a good steward? A huge part of financial wisdom comes down to saving money. By applying these principles, we can manage our finances wisely while staying aligned with Biblical values.

1. Practice Contentment

“Keep your life free from love of money, and be content with what you have, for He has said, ‘I will never leave you nor forsake you.'” – Hebrews 13:5

Perhaps the most important message the Bible has to offer regarding saving money is its emphasis on contentment. All other money-saving techniques stem from this one. The Bible urges us to ground our sense of worth in Christ, rather than in our achievements or possessions. Our value should not hinge on the size of our bank accounts, the type of car we drive or the brands we wear, but instead on our relationship with Him.

It is helpful to remind ourselves that the things of this Earth will fade away, and they will never satisfy us. The more we buy, chasing fulfillment, the more we want. We end up in a cycle of wanting and spending. When we decide to stop striving and focus on what we already have, we find more satisfaction—and we save money in the process!

Practical tip: Next time you have something in your online shopping cart, wait at least two days before you purchase it. This can help you break impulsive shopping habits, allowing for time to discern between what you really need and what you want momentarily.

2. Make (and Stick to!) a Budget

“Suppose one of you wants to build a tower. Won’t you first sit down and estimate the cost to see if you have enough money to complete it?” – Luke 14:28

Budgeting is a powerful and effective way to save money. We’ve all heard of budgeting, but making a realistic budget and sticking to it can be a challenge. Financial guru Dave Ramsey breaks down the process into five easy steps:

- List your income.

- List your expenses.

- Subtract expenses from income.

- Track your expenses (all month long).

- Make a new budget (before the month begins).

First, you must assess what’s coming into your bank account for the month. This includes your after-tax income from your job (and your spouse’s income if you are married) and any other income streams you may have that produce a monthly revenue (real estate, side hustles, investments, etc.).

Then, figure out the categories in which you spend every month.

If you practice tithing (giving 10% of your income to your church or other Kingdom causes), it can be a good practice to allocate this immediately.

Then, move on to your everyday needs: food, utilities, phone bill, shelter, transportation and hygiene.

If you have debt, include a debt repayment category.

Include a savings category. This can include contributions to your retirement or other investment accounts, adding to an emergency fund, or saving for something in particular such as a down payment on a home.

Finally, figure out your top “wants” to include. This may be a “date nights” category, or maybe you like to get a monthly manicure or want to buy some new clothing you don’t really need. This category will likely fluctuate month to month.

After you figure out the categories, it’s time to figure out how much to allot to each area.

The 50-30-20 rule is a common approach. It involves three categories of spending: 50% to needs, 30% to wants and 20% to savings. For a Christian, there is an issue: 10% for tithing is left out of this model. However, taking that 10% out of your “wants” can be a good spiritual practice of putting the Lord and others above yourself.

Budgeting can often sound boring or limiting. Instead, view it as liberating: you are giving yourself permission to spend money in a responsible way, while also saving money.

Practical tip: Include a “miscellaneous” category in your budget to cover any expenses you did not remember to account for when making the budget. This way, you won’t have to panic when something unforeseen arises.

3. Avoid Debt Whenever Possible

“The borrower is slave to the lender.” – Proverbs 22:7

Debt often comes with heavy financial and emotional burdens. It can limit our freedom to provide for our needs, give generously and enjoy life. Not all debt is inherently evil, and some debt may be unavoidable. Going into debt to get a college degree can be a long-term investment, as bachelor’s degree holders earn between $630,000-$900,000 more than those who only have high school diplomas. Similarly, debt is often unavoidable in the housing market, as most individuals have no choice but to get a mortgage.

However, there are also kinds of debt that can—and should—be avoided entirely. Credit card debt is one of the most insidious forms of debt. In the U.S., the average household’s credit card debt is just over $6,000. Credit card debt accumulates as a result of spending outside your means, which means using the card to spend more than you are able to pay.

Using a credit card is not a problem in and of itself—that is, if you pay it off in full every month on time. Before you purchase something,

Avoiding debt circles back to the principle of contentment. By living within our means, prioritizing needs over wants, and cultivating patience to save, we can avoid the vicious cycle of unnecessary debt and experience financial peace.

Practical tip: To ensure you never forget to pay off your credit card, set a recurring reminder on your phone or calendar a few days before the due date. You can also automate payments for the full balance. It’s like a safety net to catch you if you forget to pay!

4. Save for the Future

“Go to the ant, you sluggard; consider its ways and be wise! It has no commander, no overseer or ruler, yet it stores its provisions in summer and gathers its food at harvest.” – Proverbs 6:6-8

The Bible encourages us to emulate the wisdom and foresight of the ant when it comes to saving money. Planning for the future is not about hoarding wealth, but rather, it’s about stewardship—making thoughtful decisions with the resources God has entrusted to us. Saving allows us to prepare for life’s uncertainties, support ourselves in times of need and give generously without hesitation.

While living in the moment has its value, neglecting to save can lead to unnecessary stress and reliance on debt. Establishing an emergency fund is one of the most practical ways to start saving. Experts such as Dave Ramsey recommend setting aside three to six months’ worth of living expenses. This cushion can help you in financial emergencies, such as job loss or unexpected medical bills.

Beyond emergencies, consider saving for long-term goals such as retirement, buying a home, or supporting your children’s education. Proverbs reminds us that diligent preparation during seasons of plenty leads to security in seasons of scarcity.

Practical tip: Set up automatic transfers to a savings account each month. Even small amounts add up over time. Treat savings like a non-negotiable expense, just as you would your rent or utilities.

5. Be Generous and Trust in God’s Provision

“Give, and it will be given to you. A good measure, pressed down, shaken together and running over, will be poured into your lap. For with the measure you use, it will be measured to you.” – Luke 6:38

How can giving money away be way to save money?

While it’s not exactly a way to save money, it is a way to put the contentment principle into practice and increase your satisfaction with what the Lord has given you. In financial terms, giving might seem counterintuitive to saving. However, the act of giving encourages a heart of gratitude and contentment, which can lead to healthier financial habits. When we see our finances as tools to honor God and bless others, we become less prone to impulsive or materialistic spending.

Practical tip: When you practice tithing, give part of the 10% to your church and part to a different ministry of your choice. Pray each month about where the Lord is leading you to give your money. This way, you can be even more intentional in your giving.

I love the article, great post!

Thank you!